Izertis presents its Business Plan 2030: 500 million in revenues and 65 million in EBITDA

The technology consultancy Izertis has presented the key lines of its Business Plan for the year 2030, whose objective is to reach 500 million euros in revenues and 65 million euros in normalised EBITDA, which will mean tripling its current size. This ambitious plan strengthens the position of the Spanish multinational which, after a rising stock market trajectory since 2019, made the leap to the Continuous Market on 4 July, and aspires to become one of the benchmark technology consultancies in southern Europe. At the presentation ceremony, which was held at the company's headquarters in Madrid before a representation of executives, investors and institutional shareholders, Izertis chairman, Pablo Martín, stressed that "this new Business Plan 2030 reflects our confidence in the potential of Izertis and in our ability to continue growing in a sustainable and global way".

Izertis' new strategic plan is based on four growth levers:

- International expansion, with greater flexibility in its production capacity in all geographical areas:

-Serving the main world markets, consolidating and intensifying its presence in those in which it operates successfully (USA, Mexico, Panama, Colombia, Spain, Portugal, UK and Switzerland).

-Expanding its presence to new countries in Europe (Germany, Belgium, the Netherlands and Luxembourg) and strengthening its three existing production hubs - Europe, Latin America and India.

-Geographical balance in revenues, with an expected distribution of 50% in Spain and 50% internationally.

- Differentiating:

-Deepen the development of a range of services and solutions in the most advanced technological layer, with a special focus on the adoption of AI and cybersecurity in all its practices. In this area, it is worth remembering that Izertis was the first Spanish technology consultancy to certify its Artificial Intelligence Management System in accordance with the international standard ISO/IEC 42001.

-Strengthen the sectoral diversification strategy, with a special focus on strategic sectors: Financial, Defence, Pharmaceutical and Retail.

- Building a major European technology consultancy brand, recognisedfor its differential value. Long-term value creation is underpinned by the creation of a strong and prestigious brand in international markets.

- Strong corporate activity: In a highly fragmented market, Izertis has demonstrated its ability to successfully integrate numerous companies, making M&A a key competitive advantage, which it intends to continue to enhance.

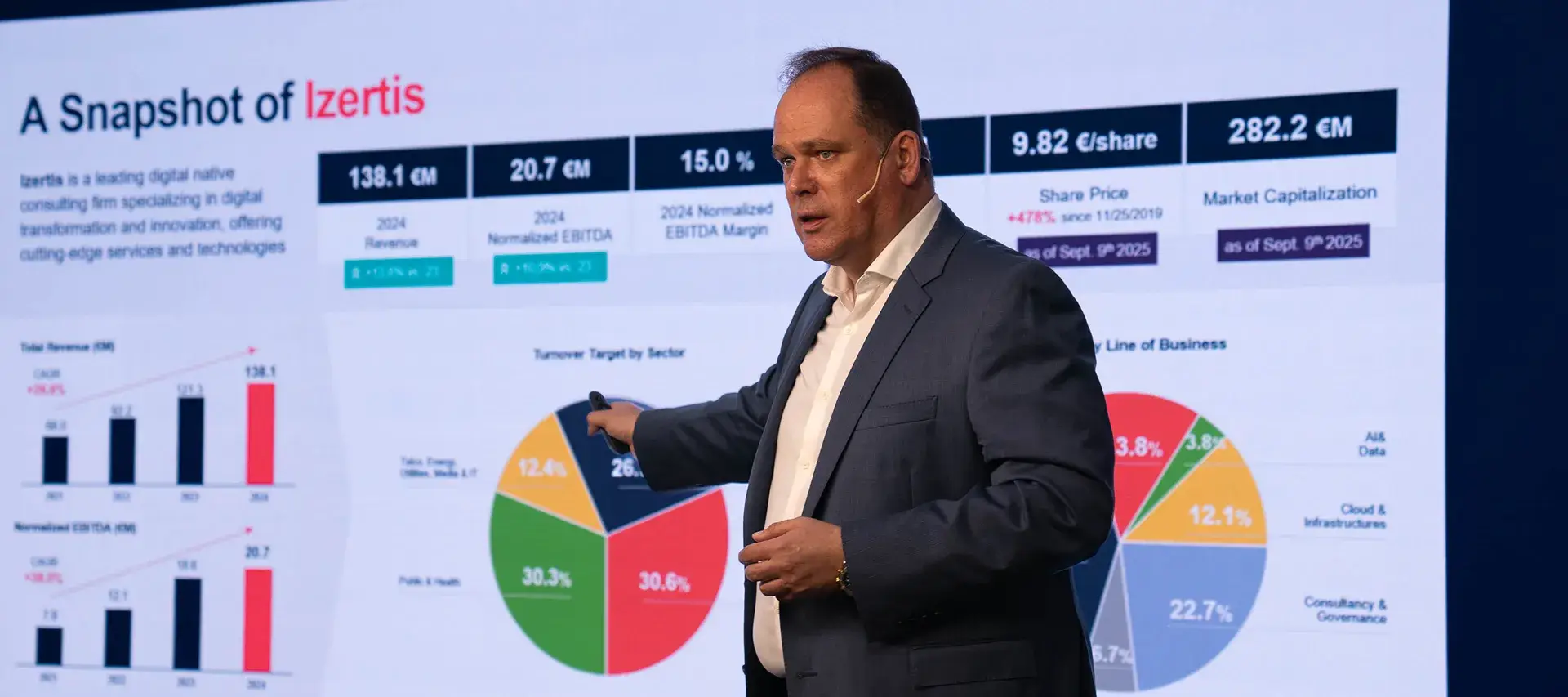

Building on a solid financial stability and capital structure, Izertis' new Business Plan for the 2,024-2,030 phase foresees reaching 500 million euros in revenues and 65 million euros in normalised EBITDA, which implies average annual growth of +24.5% in revenues and +21.1% in normalised EBITDA. A contained forecast considering that between 2017 and 2024 the company increased its turnover from €21 million to €138.1 million, which implies an average annual growth of +30.9%. In the same period, normalised EBITDA increased more than fifteen-fold, from 1.3 million to 20.7 million, with a compound annual growth rate (CAGR) of +49.2%. Last year, Izertis closed the year with 138.1 million euros in revenues (+13.8%) and a normalised EBITDA of 20.7 million (+10.9%), with a margin of 15%.

After uninterrupted growth for almost three decades, with an average annual growth rate of over 20%, Izertis' new roadmap includes maintaining the mix of organic and inorganic growth, supported by the integration of high value-added companies. The multinational technology company has completed 43 corporate integrations since its creation, the last five of an international nature, thus consolidating its global profile and a sustainable, competitive and innovative growth model.

Stock market trajectory and road shows

Izertis debuted on BME Growth in November 2019 with an exit price of €1.70 per share and in July 2,025 made the jump to the Continuous Market, with an initial reference of €10.50 per share and a capitalisation of €273.79 million. At the close of trading yesterday, 9 September, the share stood at 9.82 euros per share, with a market capitalisation of 282.17 million euros.

The multinational technology company's management team and employees hold a position of over 18%, specifically 18.22%, making them the second largest shareholders after its chairman and founder, Pablo Martín, who holds 46.12%. The Anémona Group owns 5.51%, while the free float is 29.13% (data as of July 2025).

It is currently covered by analysts at Renta 4, JB Capital Markets and Alantra, who place the target price in a range between 11.8 euros and 16.1 euros per share, with a buy recommendation.

Over the next three weeks, Izertis will hold a national and international roadshow to present the new Business Plan to relevant institutional investors in the main cities of Europe and Spain (London, Paris, Milan, Frankfurt, Madrid, Barcelona and Bilbao).