Strategy, innovation portfolio management vs portfolio improvements and evaluation methods

The strategic management of the portfolio consists of selecting, evaluating and prioritizing the projects in the portfolio, ensuring that those to be executed are not only aligned with the strategic objectives of the organization, but also those that provide the greatest value to these objectives.

Given that the correct selection and prioritization of projects is the key to success, this article details a series of relevant aspects to consider in this process: the importance of the strategy, the difference between the portfolio of innovation projects and that of improvement projects and, finally, the different evaluation methods.

The importance of strategy

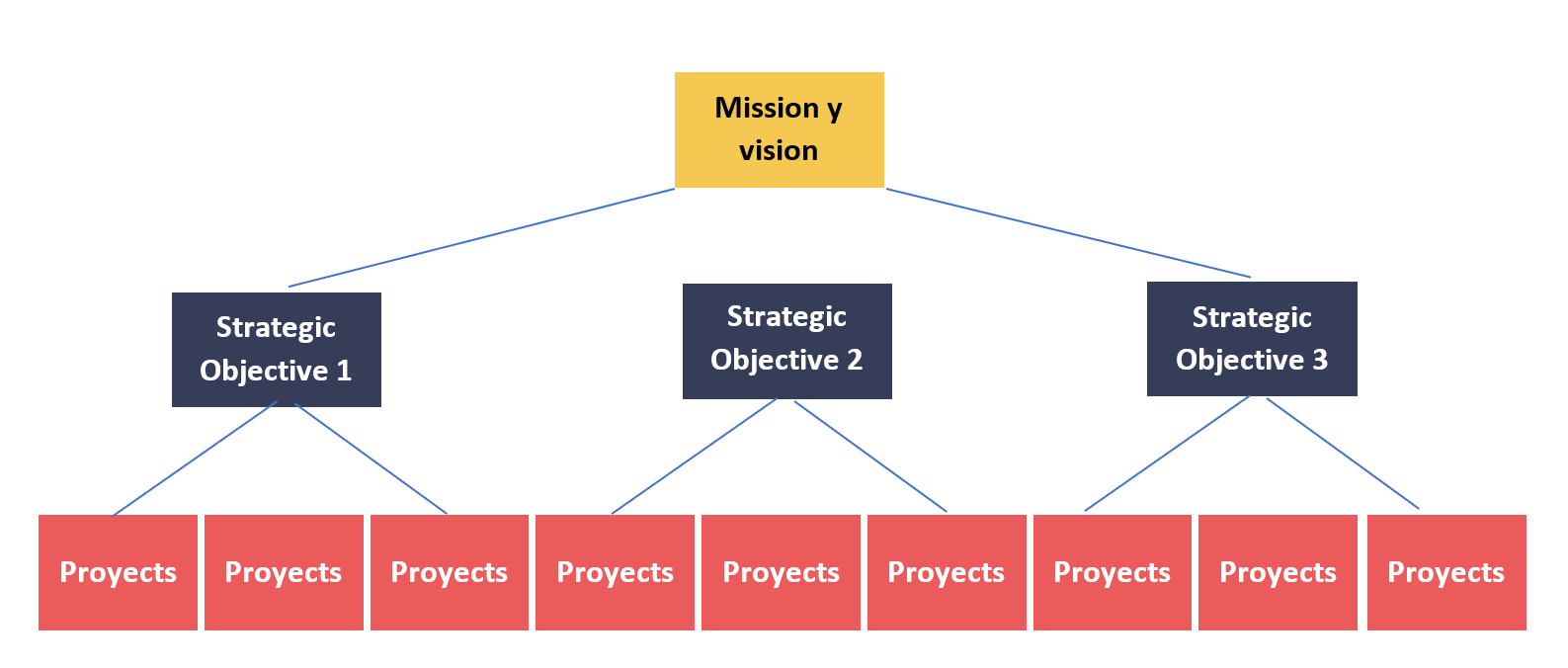

The strategy must be defined before approaching the selection of the portfolio, since it is the structuring element of the portfolio and sets its objectives.

But, how many strategic objectives should define an organization consider? In the 50s of the 20th century, psychologists determined that our working memory is limited. That is, we can maintain and manipulate mentally and consciously a limited amount of information for a short period of time and that limitation was established by nothing more and nothing less than approximately 7 elements only.

Considering the previous limitation, it seems reasonable that between 3 and 7 strategic objectives are contemplated. A small number of objectives helps a better management. Additionally, it avoids that mapping projects with objectives is an excessive effort. For example, considering 50 projects and 7 strategic objectives, 350 mappings are required. With 20 targets the number of mappings required would be 1000.

It is important to note that the strategic objectives should be broad and generic enough to be valid for at least the next 3 years (traditional period of a Strategic Plan). The validity of these objectives should be at least equal to the time required for the implementation of the projects and subsequent realization of benefits, although, in current times, where uncertainty is part of the day-to-day business, it is perhaps necessary to review those goals more frequently.

Is there a correct way to align strategic objectives with projects in a company?

It could be considered that if the strategy involves all business areas of the company, then the implemented projects should also affect all areas. On the contrary, if the projects are a subset, such as the projects in the Technology area, then it makes more sense to select them considering only the strategic technological objectives. The correct way to carry out the selection and prioritization is to have the projects and the strategic objectives defined at the same level.

Portfolio of innovation projects vs portfolio of improvement projects

The portfolio of projects of a company may have different criteria to be categorized, however it is necessary to make a clear distinction between the proper innovation and transformation projects and those that involve improvements.

Success criteria and metrics for innovation projects are substantially different from improvement projects. The period of the return on innovation also varies. As a general rule, an innovation project is not profitable during the first five years, but after that time the profitability could increase significantly. On the contrary, a process improvement project will generate closer and more constant returns.

Managing innovation projects and process improvement projects in the same portfolio under the same criteria, probably entails inadequate management of either the innovation projects or the others. Or even in the worst case, it could lead to both being mishandled. This is because the management and leadership style necessary for innovation projects is significantly different from that required for a portfolio of improvement projects.

In practice, this means that there will be a single global portfolio to monitor how resources are allocated, but there will be a differentiated treatment of innovation projects vs improvement projects.

Therefore, it is recommended that innovation and improvement projects be managed separately and even under different models.

Optimized and balanced portfolio

Optimized and balanced portfolio in terms of the use of organizational resources, technical feasibility and achievement of strategic objectives.

The Project Management Institute (PMI) defines portfolio selection as the process of selecting components (projects, programs, and others) that make up the organization's portfolio mix. There are a number of ways that selection can be done. On the one hand, projects are selected because a manager in the organization believes that a project should be undertaken. On the other hand, there are complex mathematical methods that can be used for portfolio selection. Whichever method is chosen, the objective of the organization will be to select those components of the portfolio that provide the highest possible value for the company.

A fully optimized portfolio balances the optimal use of resources, technical feasibility and the achievement of strategic objectives. The interaction between these 3 aspects can be seen as a triangle, where the business profit is the area of the triangle:

In this way, a change in one side of the triangle will modify the area and, consequently, the profit for the business.

Portfolio evaluation methods: non-numerical analysis and numerical analysis

The management of a portfolio of projects, according to the PMI, is the coordinated management of one or more portfolios that allow an organization to achieve its strategic objectives and in which processes are executed that allow the evaluation, selection and prioritization of its components, as well as balance allocated resources.

In the component analysis process, two categories are considered: numerical analysis and non-numerical analysis. During the evaluation process, the combination of both categories could be considered.

Numerical analysis examines the attributes of components that can be represented by a calculated numeric value. Generally, it consists of financial ratios such as the Net Present Value (NPV), the Internal Rate of Return (IRR) or the amortization period, among others.

One of the notable advantages of numerical models is that the result can be used as an indicator of the viability of a single component or as a measure of comparison.

Non-numerical analysis studies the attributes of a component that cannot be easily or immediately quantified or calculated using formulas and, therefore, are often subjectively evaluated. These attributes include aspects such as brand perception, employee morale, employee perception, usability, etc.

The nature of the portfolio, the use of numerical and non-numerical analysis, balancing the optimal use of resources, technical feasibility and the achievement of objectives must be considered

It is very important that the portfolio selection and development strategy is correct to achieve the organization's objectives and positive and profitable results. For this, the nature of the portfolio must be considered (innovation vs improvement), the use of numerical and non-numerical analysis, balancing the optimal use of resources, technical feasibility and the achievement of objectives.

At Izertis, we are specialists and we have helped various of our clients in the preparation, implementation and monitoring of Annual Plans as well as in the alignment of portfolios, programs and projects by defining categorization criteria and prioritization models of initiatives, adapting to your business culture and defining portfolio review and monitoring models (usually by setting up Portfolio Committees) as often as necessary to adapt to the agility of your business.